Financial managers are constantly being asked to do more with less. It is important to track every payment: to know exactly what you owe, to whom, and when each payment is due.

Analysis of this information provides insights into opportunities for freeing up cash and aiding the budgeting process.

Working capital is the money used in day-to-day trading operations in your business.

Working capital optimization means optimizing the balance between assets and liabilities, and the effective management of cash flow in order to meet a company’s short-term operating costs and debt obligations.

Understanding payment term opportunities can provide well-needed negotiation leverage for instance in the event of proposed increases.

So, in this blog, we'll cover how payment terms can be part of your working capital optimization.

Why working capital is important

One of an organization’s main obligations is to pay suppliers’ invoices on time, but there is more to it than that.

In order to optimize working capital, an organization must also consider new incoming receivables, the appropriate level of inventory, and the cash balance.

The efficient management of these components ensures the profitability and smooth running of any business.

There are times when additional working capital must be found to fund obligations to suppliers, employees, or other third parties while waiting for payments from customers.

So, consideration of all these components can avoid less than ideal cash flow hiccups.

See how contract analytics can be part of your Procument Analytics toolbox.

What are the benefits of working capital optimization?

In very basic terms, the key benefit of optimizing your working capital is having more cash freed up from the balance sheet (i.e., not tied up in transitional states).

Yet, there’s more than meets the eye to this fundamental accounting principle. Here are 3 benefits:

- When processes are fine-tuned, inventory moves faster. Commercial agreements like payment terms can be renegotiated more frequently. This directly impacts profit margins.

- Optimizing processes allows for more flexibility in the market. It enables shorter lead times and adaption to market shifts. Ideally, once these core operational processes are streamlined, management can focus on more strategic initiatives.

- Finally, having more optimized cash flows means less reliance on external funding. Working capital optimization can keep the core operations of the business in check while increasing money at hand to pursue new opportunities in market.

Introduction to payment terms

There are multiple ways to optimize your cash flow.

To start, the organization must define a working capital strategy. In this article, we’ll focus on strategies regarding payment terms.

What are payment terms?

Payment terms are usually agreed upon with suppliers, or specified to them, at the time of contracting.

Terms are expressed as a time interval within which full payment is due. For example, “Net 30 days” means that the full amount is due for payment within 30 days.

Payment terms affect cash flow, profitability, sales growth, credit, and supply risk. Teams can evolve from being a cost-saving function to being a cash flow-generating function by better managing payment arrangements with suppliers.

Who decides payment terms?

The functions which will have the most effect on payment terms are Accounts Payable and Procurement. Together these functions must process and negotiate all trade receivables and trade payables, money owed, and money earned.

Therefore, optimizing payment terms is the most direct way to increase working capital. In most cases, the balance of payment terms is biased towards trade receivables.

That means in practice that the organization wants to pay their bills as late as possible while receiving their money as quickly as possible. However, there are downsides to this mindset that affect cash flow and operational efficiency.

Delaying payments can impact supplier relationships resulting in delivery dates being missed and slower response times to queries and issues. By paying early, suppliers may offer benefits such as discounts or rebates for early or on-time payments. Getting accounts payable right is a delicate balance.

The risks of inefficient accounts payable

When accounts payable process aren’t up to speed, the company struggles to process invoices on time, take advantage of supplier discounts, and leverage more desirable payment terms.

Deloitte has identified several causes of these inefficiencies:

- Relying too heavily on manual processes to approve requisitions

- Failing to issue purchase orders for each new order

- Not confirming if order deliveries match contractual terms or not easily accessing vendor contracts

- Losing access to early payment discounts by over-extending payment cycles

- Neglecting to take advantage of maximum savings through volume rebates or trade spend initiatives

- Incorrectly loading supplier and/or contract information into master data files

- Lacking processes and systems to prevent late payments, under- or over-payments, duplicate payments or missed payments

How to optimize payment terms

There are several methods to go about optimization through payment terms:

- negotiating longer payment terms with their suppliers

- implementing shorter payment terms for their customers

- creating incentives for early payments, and

- applying invoice financing methods.

However, all of these strategies require thorough analysis to know your cash flow position and ideal terms.

Payment term analysis

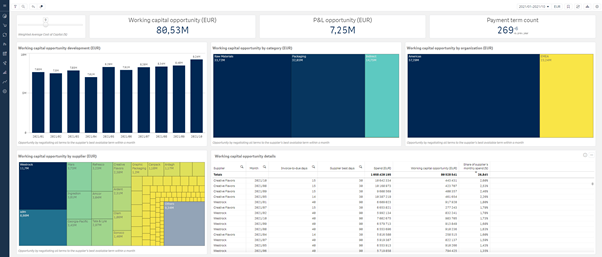

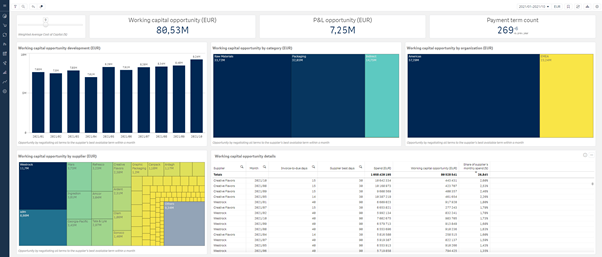

Image: demonstration of Sievo dashboard “Payment terms opportunities”

Performing detailed analysis through procurement software on payment terms provides companies with the opportunity to streamline and harmonize their policy within the procure-to-pay (P2P) process.

Doing a “what if” analysis can establish what the financial effect is, for example, when terms of Net 30 are changed to Net 60. Procurement teams can identify those suppliers where negotiating better terms would have the largest impact without introducing risk.

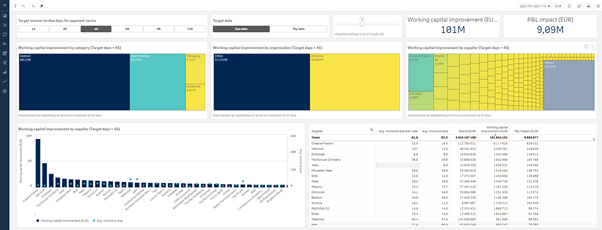

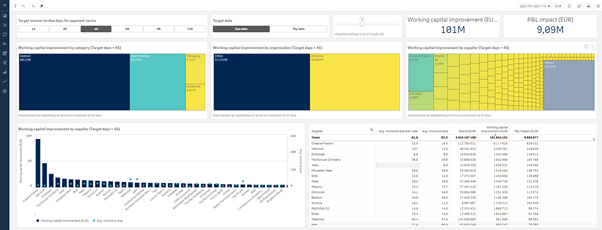

Image: Example of Sievo dashboard “Payment terms scenarios”

Invoice processing data can highlight unusual payment patterns. Over time and across multiple contracts and locations, strategic suppliers may have different payment terms applied to them on a functional and local level.

Harmonizing payment terms per supplier through renegotiation means cost savings, reduced administration time, and better supplier relationships.

Negotiation of payment terms

Once you’ve completed your analysis, the art of negation comes into play. Obviously, there are going to be differing intentions between parties.

For this reason, being on good terms in the first place with your suppliers is fundamental and will positively impact every step along the way.

Best practices in negotiation

Consider your relationships with key suppliers: do you consistently meet payment terms? Do you respond to their messages and check in? This will open many doors already when negotiating payment terms.

However, not every supplier is worth approaching. In most scenarios, you want to focus on your key suppliers when negotiating payment terms, as they will have the most impact on cash flow.

That being said, you must ensure that you are talking to the right person. That role may be the CFO or COO, depending on the size.

Yet, the only way of knowing is by keeping a close eye on individual suppliers. When proposing an offer to change payment terms, a great technique is to start with an across the board change rather than singling one supplier out. From this angle, you can ask why they should be exempt from the change.

Finally, it’s critical that the offer be mutually beneficial. By making your supplier understand that great cash flexibility may increase order volume, you are highlighting mutual benefits in clear terms. Aim high, but be prepared to settle lower.

Make sure you are as invested in their success as they are in yours. You don't want to negotiate too harshly and drive your best supplier into financial trouble either.

Optimizing cash flows is a give-and-take process that is never finished. However, the more you can free up cash, the more you will produce, the higher your profits, and the more contingent business you will have.

Quick tips to improve cash flow in accounts payable

- Analyze current invoice payment data by each period

- Utilize a procurement analytics software to identify and visualize payment term opportunities on category and supplier level

- Conduct a gap analysis to determine how your performance compares to industry peers, competitors and best practices

- Focus on building good relationships with your key suppliers

- Define target payment terms and renegotiate agreements with suppliers and customers.

Sievo payment process analytics enables you to spot improvement potential and take action to improve your working capital. Identify payment terms where there is potential for renegotiation.

Cover image by Mick Haupt, Unsplash