Supplier segmentation is the process of allocating suppliers into distinct groups so that limited resources can be allocated to manage them effectively.

It is one of the building blocks of a supplier relationship management (SRM) program.

In this article, we'll cover the basic methods of supplier segmentation and give a few best practices.

Why is supplier segmentation important?

Organizations need to build sustainable partnerships with their strategic suppliers to obtain the best value possible. Suppliers you can identify as strategic or key to your operations need a high level of engagement and closer focus than others.

By segmenting your suppliers into groups based on certain criteria, you can decide on the type and level of attention needed.

Segmenting suppliers can also identify your level of exposure to risk, e.g. a single source of supply for a product or service.

The overall end goal, though, is to create more strategic relationships with suppliers.

Wondering how supplier segmentation can support your procurement analytics? Read this complete guide!

The main benefits are:

- Reduced costs

- Process improvements

- Encouraging innovation in products or services.

To achieve innovation, you first need to be open and transparent with those key suppliers and focus on building trust.

It is not practical to monitor or work with all suppliers closely. There needs to be a balance between time spent on monitoring suppliers and the benefit to be achieved.

That's where segmentation comes in. Here are two basic methods to get you started:

Ways to segment suppliers

The most common methods and the Matrix and Pyramid approach.

The matrix approach

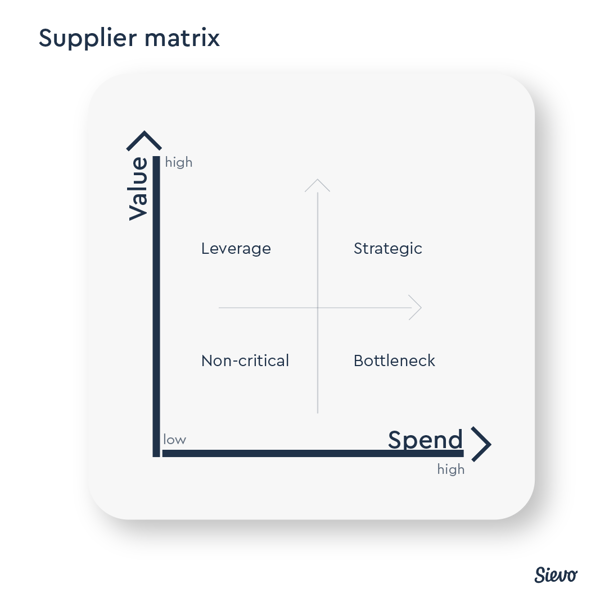

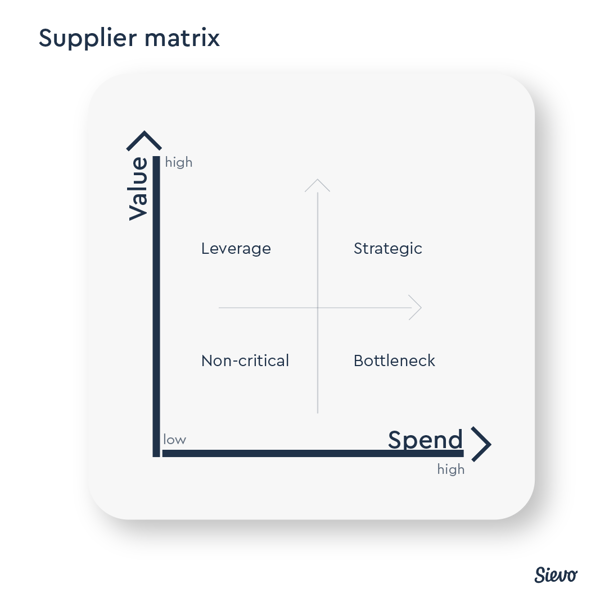

The volume of spend is often the starting point of supplier segmentation. When plotted alongside value, we have a framework for splitting your supplier base into different segments. Value is defined as how important a supplier is in terms of business continuity.

Strategic suppliers usually make up around 10% - 15% of the number of suppliers in the database. This classification method, based on the original Kraljic matrix, can be customized to provide more detailed sub-groups within each quadrant.

At its simplest, High value/High spend is often deemed Strategic.

The pyramid approach

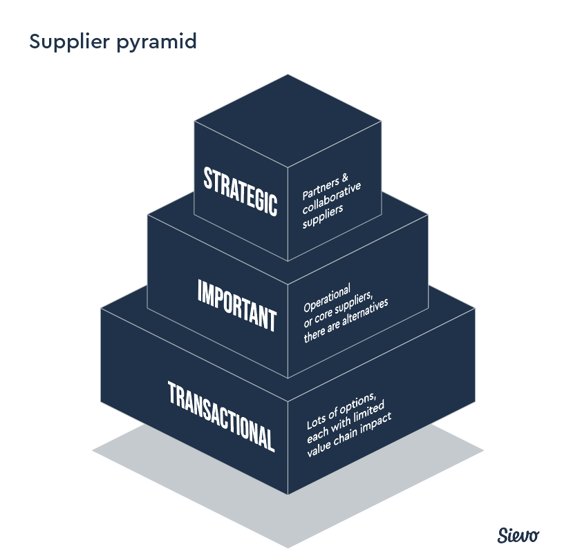

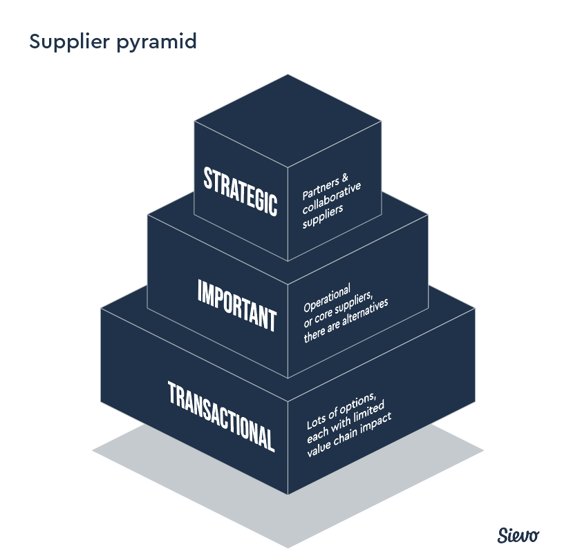

A pyramid is a different way of viewing the supplier database using the same priorities: strategic, important, and transactional.

This is often the preferred way for medium and smaller-size companies to segment suppliers.

A supplier pyramid typically has 3-4 tiers, depending on whether partners are split into their own group at the top of the pyramid or grouped in the strategic category.

As we move up the pyramid, the value of suppliers increases and the number of suppliers in that category decreases.

Factors that influence segmentation

The main aim of supplier segmentation is to identify where you must focus on maximizing the potential of supplier relationships. There is no one preferred approach to supplier segmentation, pick the one that suits you.

The industry you are in and your type of business also influence your approach.

Consider the following factors in addition to the basic segmentation qualities (Spend/ value):

- Your projected spend growth

- The complexity of the service or products purchased

- The value a supplier brings to your business e.g., innovation or continuous improvement

- Whether the supplier is global or regional

- How many business units buy from them

- The potential supplier risk (failure to supply, financial impact)

- The potential of the supplier (a smaller diverse or local supplier might be more valuable than your current spend with them suggests).

Best practices in supplier segmentation

No matter how you assess your suppliers in segmentation, keep these best practices in your back pocket:

The 80/20 rule

20% of the supplier database usually accounts for 80% of total spend, meaning these are the best place to look first.

Don't neglect subjective data

Consider both subjective and objective input when segmenting key suppliers. This means considering quality, responsiveness, delivery performance as well as overall spend.

Share your findings

Share the chosen model with internal users so that all touchpoints with a supplier model are covered. This will ensure consistent messaging and promote better relationships.

Continuous improvement

Engage your key suppliers in conversation about innovation and continuous improvement. Relationship building has its financial rewards – it should be mutually beneficial.

Frequent review

Supplier segmentation is not a one-and-done exercise. Review your segmentation at least annually. Economies are dynamic, and risk profiles change. A once-strategic supplier may have to be reassigned if a product or service is no longer fit-for-purpose.

Use technology to smooth the way

Spend analysis tools are a must-have in large procurement organizations. It could make sense to pre-allocate your suppliers automatically based on annual spend into three main groups: strategic, important, and transactional as a starting point.

Suppliers can then be reallocated, as required, by the user based on other qualitative information. Sievo's Spend Analysis solution includes a supplier segmentation tool that allows users to update supplier segmentation values directly in the analytics interface.

Spend can then be analyzed by supplier segment across dashboards like price opportunities, payment terms and spend development.

Header picture by Osama Elsayed