When inflation is eating up your profit, understanding your spend is as important as ever.

Spend analysis provides insights into what functions have the best financial performance and where you spend more than you should.

Get started with Spend Analysis through our full guide.

As your procurement resources are limited, you want to focus your inflation control efforts on where it matters most.

This article elaborates on Wessman's economic insights for procurement and how you can navigate global crises. You can see the full presentation from SievoFriends 2022 on-demand.

Global economy shocks

The global economy has recently survived two big shocks: the COVID pandemic and its legacy and the ongoing war in Ukraine with increased defense spending. Procurement and supply chain must adjust to cope with these events.

We are experiencing shutdowns across many industries and sanctions against the Russian Federation, creating supply chain disruptions. The demand is greater than the current supply.

Too much money is chasing too few goods resulting in inflation. To get inflation in check, central banks are raising interest rates, causing a global economic slowdown and leading to recession.

They will continue to raise rates until inflation starts to fade.

Why inflation occurs?

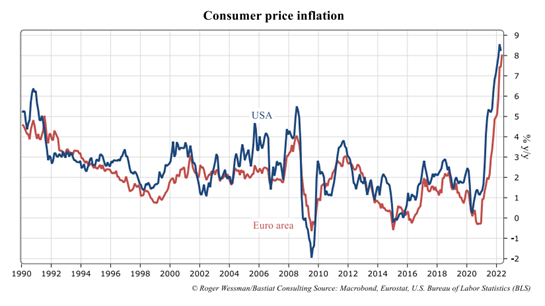

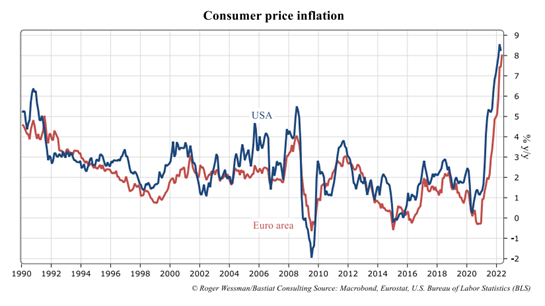

Inflation has been speeding up since the beginning of 2022 globally. In September 2022 inflation was already at 10%.

Image: Consumer price inflation 1990-2022

Global demand has recovered faster than supply, pushing prices up. Households and companies have accumulated more cash to spend since 2020.

The shortage of workers is feeding the rise in wages, further boosting demand. In this environment, it is very difficult for the economy to grow.

The current high inflationary environment pressures consumers and buyers everywhere to find savings and extract more value from their purchases.

In Europe, the war in Ukraine has exacerbated the rise in energy and agricultural prices. Russia is one of the world’s largest exporters of fertilizer. This, along with the shortage of natural gas, is pushing up the price of electricity in Europe.

As much of the gas is supplied by pipeline from Russia, it is difficult to change suppliers. The pressure on gas prices will increase as European countries find other sources.

Watch webinar with Mintec: How rising energy costs affect commodity food commodities

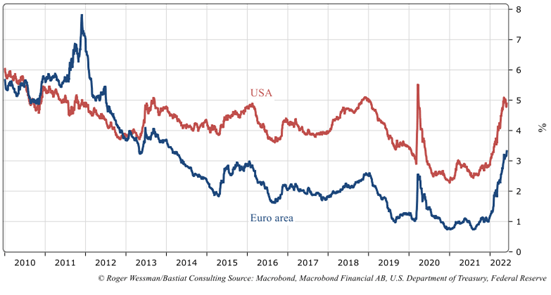

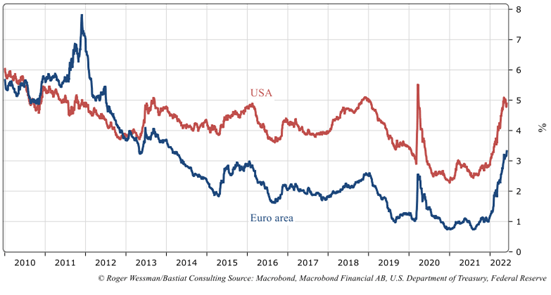

The US and European energy prices will even out as transport capacity rises. Higher interest rates will continue to make it more expensive for corporations to invest.

Image: 10-Year Corporate Bond Yields

The global economy is already cooling down, the effect is already seen in industrial metals prices. China is opening up as they get the pandemic under control.

However, the virus is still spreading, and there may be more future shutdowns. Be prepared for this and a worsening decline in Russian energy exports.

How to beat inflation and improve financial performance?

The impact of inflation can be seen across the industry fields. Energy-intensive industry fields are in the most difficult position. Industries that can make price changes relatively quickly are in a better position.

Balancing the right price and profitability requires understanding your cost structure. When the fixed costs keep increasing, companies need to either increase sales or find savings elsewhere.

Finding savings is often a more effective way to improve short- and medium-term performance.

Optimizing your costs should be the first step. Companies should consider TCO before increasing prices, as increases may impact customer loyalty and competitive advantage.

Spend analytics provides insights and reveals savings opportunities. Advanced spend analytics solutions support scenario analysis when adapting your supply chain quickly.

Examples of potential savings areas:

- Supplier consolidation and volume discounts

- Payment term optimization for improved liquidity

- Improved process efficiency for lower labor costs

- Outsourcing some less business-critical processes

- Substituting a material with another

- Changes in service scope, and many more.

Read our Ultimate Guide to Procurement Cost Savings to get all the strategies you'll need in one place.

The price risk facing procurement

The pandemic was a wake-up call for most companies. Inflation is an additional new element of risk in the supply chain. We know that inflation in energy prices is still with us, but pricing is difficult to predict in the services categories.

Preparing for the worst, improving forecasting accuracy, mitigating risks, and building resilient supply chains have been in Procurement focus since then.

It's smarter to prepare for the worst-case scenario in advance than be over-optimistic.

It's easier to find investment cases for the excess budget than to realize additional savings when you’re over budget.

Understanding your supply base and knowing your suppliers is vital. Your suppliers are facing similar hardships, so prepare for tough pricing discussions.

Crises are impossible to predict – each functional area and procurement category must have mitigation plans. Stay close to the market data and communicate with people who know more than you. Finding savings and efficiencies together with your partners is the key to surviving turbulent times in the market.

How Procurement can fight inflation

The role of CPO and Procurement is critical in navigating the turbulent times in the macro-economic environment. The crises hit Procurement hard, causing price pressure and supply shortages while the organization expects savings.

While the situation is tough, it’s a great opportunity for Procurement to step up. Procurement is in a key position between the external markets and internal operations to collect, combine, refine, and use the information to make the right decisions that benefit the whole organization.

To get in that position, robust processes and supporting technology need to be in place.

- First, develop the understanding of current state spending and contract base, where change can be made, and what kind of contract terms are in place related to, e.g., yearly increases.

- Second, understand the impact of fluctuating raw material and commodity prices on spending and product profitability.

- Lastly, apply scenario analysis to understand the impact of changing prices and volumes on the business in the next 12/18 months.

Sievo provides a holistic portfolio of analytics tools to equip Procurement to manage the ever-increasing uncertainty in global supply chains.

Our software helps you to build complete visibility on your spending, understand your exposure to market price risk and support you in creating predictions for the future.