Category Management (CM) is a strategic approach to procurement where organizations group together similar areas of external spend to identify opportunities for consolidation and to create added business value.

The approach was originally used mainly for project-based sourcing but has expanded to include spend analysis, market intelligence, performance development, sustainability considerations, reporting, and risk mitigation.

In this article, we'll cover:

What is category management?

Category Management provides a systematic, cross-functional process for developing and implementing best practices.

Organizations use CM to:

- Align procurement activity with business strategies.

- Develop category-specific plans.

- Manage suppliers according to market conditions and performance.

- Improve transparency in how money is spent.

Benefits include cost efficiency, improved quality, efficient use of resources, improved market understanding, streamlined business strategies, and improved collaboration.

Is Category Management the same thing as Strategic Sourcing?

The term Category Management is often used interchangeably with strategic sourcing, but the two are not the same.

-

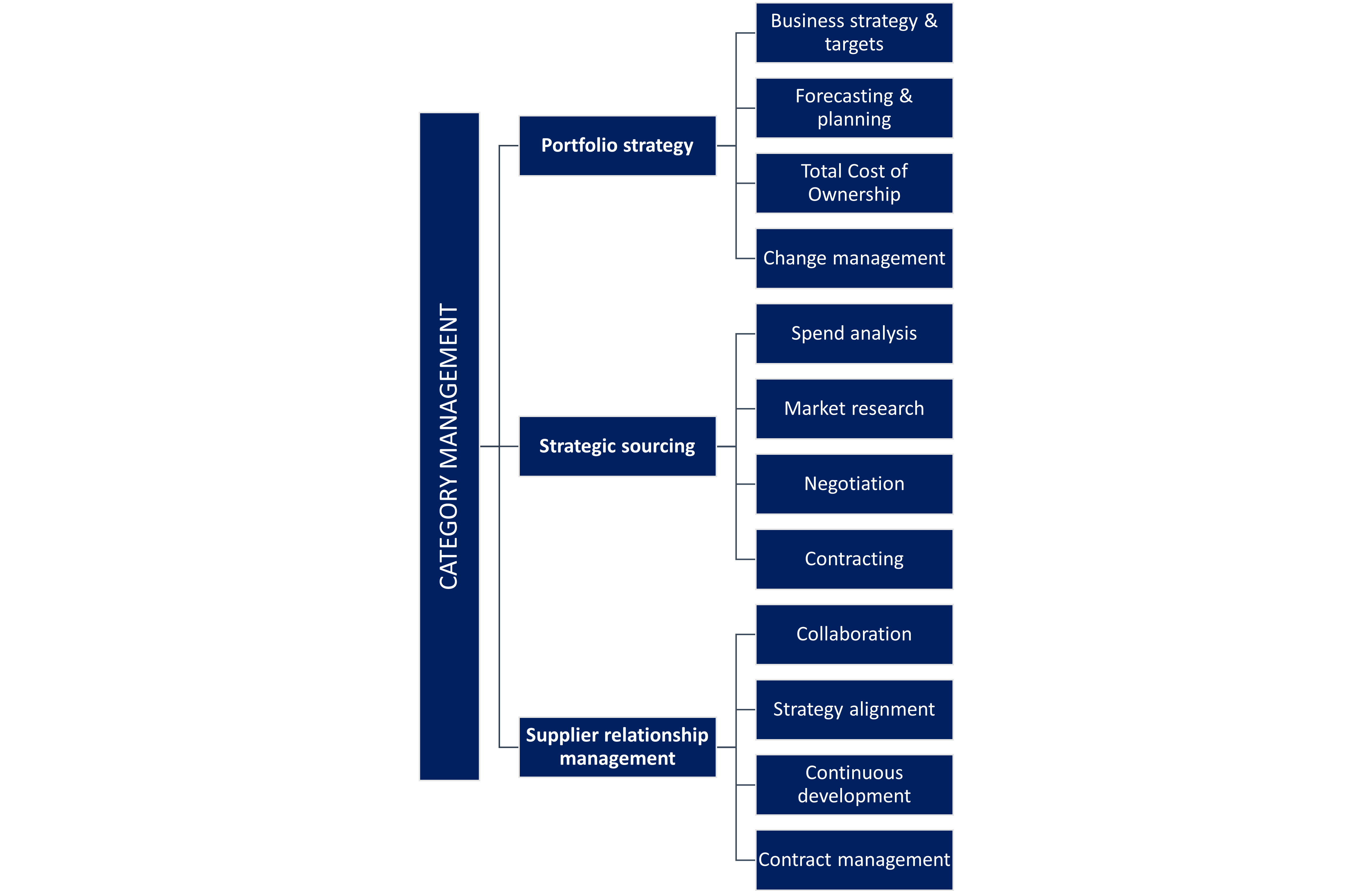

Category management covers the entire lifecycle of a defined spend area. It includes strategy, sourcing, supplier performance, risk management, and continuous improvement.

-

Strategic sourcing focuses on identifying suppliers and securing agreements that meet business requirements at the lowest total cost of ownership (TCO). It typically involves spend analysis, market research, tendering, evaluation, negotiation, and contracting.

The strategic sourcing process combines spend analysis, market research, negotiation, and contracting.

Procurement Analytics Demystified gives you an understanding of the power of data behind category analysis -- check it out!

Strategic sourcing is a key activity within CM framework as seen in this example:

What Are Procurement Categories?

A procurement category is a logical grouping of goods or services with similar cost drivers, supply markets, and usage patterns. Examples include IT, logistics, marketing, professional services, packaging, or maintenance.

How categories are defined depends on:

Categories can be structured using global standards such as the UN Standard Products and Services Code (UNSPSC) or through an internal spend taxonomy. The purpose is to group items consistently so spend and suppliers can be managed in a coordinated way.

There is no correct way to categorize spend, but there are best practices. Don't know what to consider when designing your taxonomy? Have a read!

What are Direct categories?

The term “direct” is typically used to refer to raw materials and items used in the manufacture of goods for resale. Direct spend management is the process of purchasing or obtaining materials, resources, goods, and services used in a business's core operations.

They are vital to the business and are often acquired in large quantities, are of high value, and are sourced from trusted suppliers. Practical examples would be chemicals for the manufacture of soaps or engine parts for airplanes.

What counts as “direct” varies by industry. For example, IT may be a direct category in financial services because it enables core delivery but indirect in manufacturing where physical materials define production.

For a fuller read on direct procurement, see: What is direct material procurement? Definitions, types, and examples.

What are Indirect categories?

Indirect categories support daily business operations but are not part of the end product. Common examples include marketing, utilities, facilities, telecommunications, and professional services such as legal, HR, and consulting.

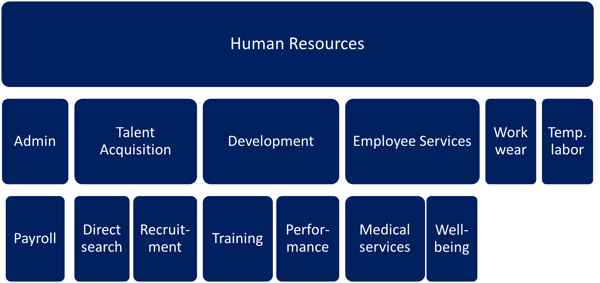

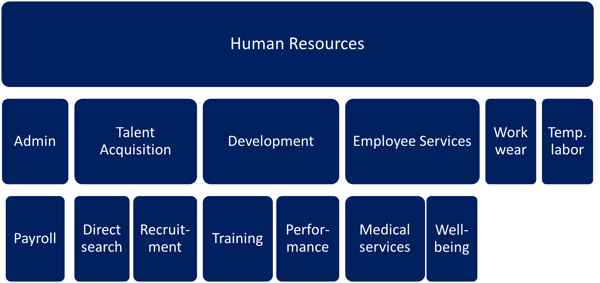

All sub-categories require focus and expertise as many services have specific pricing models and market characteristics. In the following example, we open up the level of sophistication.

Case Example: HR category in transition

The HR category is becoming more complex to manage as we deal with major changes in work life. Distance work allows us to source the best talent without geographical limitations.

There is a trend in flexible employment models and freelancing that benefits both organizations and individuals. A highly specialized skillset is required to be successful in talent acquisition as new competence domains emerge.

Talent attraction today is more than just a competitive salary and permanent contract. There is a new expectation level for what is considered employee wellbeing. New technologies are emerging for performance management and development.

Workwear needs to be more sustainable, potentially with circular economy consideration. All these elements will have an impact on category management and sourcing decisions.

In addition to market changes, there is a constant drive by top management for cost savings in this area, which is challenging even for the most seasoned HR procurement professionals.

Procurement needs to collaborate proactively with the People team to optimize the balance between core internal resources and such expertise that could be outsourced cost efficiently without losing strategic business capabilities.

Simultaneously, HR suppliers can be local or global, while the hundreds of stakeholders are spread around the various business functions.

Example of the HR category with sub-categories:

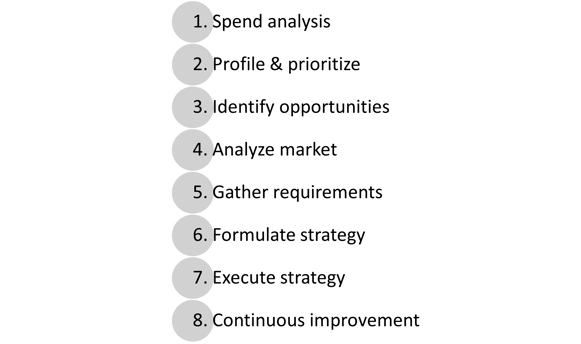

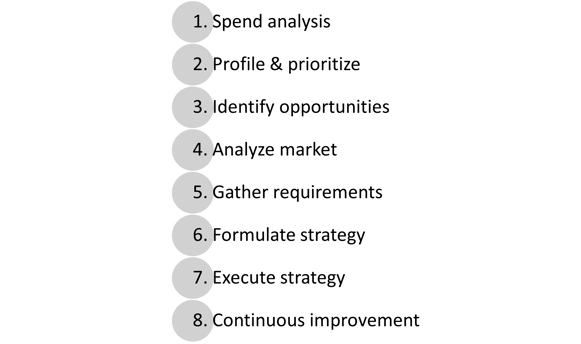

How does category management work in practice?

CM will cover the entire procurement cycle from sourcing to managing the supplier relationships. The main objective is to manage each category and sub-category of spend holistically, through their entire procurement lifecycle.

An effective process could look like this:

A category plan is critical to successful category management initiatives. It is documentation that includes category targets, stakeholder requirements, opportunities, prioritization, resourcing, and scheduling of activities.

The category planning process is led by a category manager who directs the portfolio, and runs the day-to-day activities and strategic sourcing. A category manager is a procurement role that is responsible for overlooking a specific area.

A category manager will track the market to understand pricing trends, regulatory changes, and innovation for the entire category. Category plans can be developed for the long-term (3 – 5 years), medium-term (1 – 3 years), and short-term (quick wins).

Categorizing historical spend in a structured way creates opportunities for cost savings and extracting more value from suppliers. The trend in category spend management is towards full transparency, which is being achieved partly through the application of digital tools. A higher level of transparency leads to greater insights and business value, as more professionals can identify opportunities for improvement and strategic sourcing.

What are best practices in category management?

Turning data into category insights with spend analysis is a good starting point, but isn’t enough to succeed in ambitious development efforts. Leading category managers spend a significant amount of time with stakeholders and end-users to understand their business needs so they can jointly support the organization’s goals.

Active stakeholder collaboration, networking, and benchmarking are keys to success. It requires multiple areas of expertise, such as

- stakeholder identification and management,

- supplier relationship management,

- performance management & development,

- sustainability & environmental management,

- risk management,

- effective communication

- and leadership skills.

Success is enabled by: People, Technology, and Tools.

At best, a category manager is a value-adding partner, that supports market analysis, external resource management, supplier performance development, and realization of business targets.

Benefits of Category Management

Organizations often see measurable benefits when categories are managed systematically:

- Consolidation opportunities: fewer suppliers and more consistent contract terms.

- Spend visibility: clearer understanding of where money is spent.

- Improved supplier relationships: defined contacts and coordinated communication.

- Better fit to user needs: deeper knowledge of requirements within the category.

- Risk and governance improvements: better understanding of category-specific risks and compliance.

- Support for business strategy: category objectives aligned with organizational priorities.

How to Overcome Barriers

Category management is continuous improvement and execution of the strategy. Markets keep evolving and not all changes are positive. A strategy that works well today might deliver opposite results tomorrow.

Obtaining stakeholder support for category strategies is not always easy. Business units have their own agendas and can be skeptical about potential misalignment, failure to understand their specific business needs, failure to supply, lower quality, and losing their preferred partners.

To address these issues, category managers usually focus on:

-

Clear communication of category goals and expected outcomes

-

Early involvement of stakeholders

-

Transparent assessment of options and trade-offs

-

Use of analytical tools to quantify opportunities and risks

-

Regularly reviewing category performance and sharing results

To prove your value, you need to excite your business partners with new insights and be willing (and able) to share your expertise. The sheer volume of historical category spend cannot be managed manually to provide guidelines for category plans.

Being able to share your wins and true category management impact in a transparent, unquestionable format is critical to earning stakeholder trust and mandate to operate.

Photo by: @mirapolis