In any manufacturing company Purchase Price Variance (PPV) Forecasting is an essential tool for understanding how price changes in purchased materials affect future Cost of Goods Sold and Gross Margin.

This helps business stakeholders to make more informed pricing decisions and finance functions to give more accurate forward-looking statements on overall future profitability.

In this article, we'll explain what PPV is, how it's used in budgeting and performance measurement, and how to forecast it.

How to caluculate PPV

Purchase Price Variance is the difference between the Actual Price paid to buy an item and the Standard Price, multiplied by the Actual Quantity of units purchased. Here is the formula:

PPV = (Actual Price – Standard Price) x Actual Quantity

What PPV means

PPV can be used to quantify the efficiency of a company’s procurement function.

Negative PPV is considered savings and thus good performance from the procurement organization.

But this is a very simplistic approach as commodity price volatility is often outside the control of buyers. In the worst cases, PPV as a performance measure can lead to politics around Standard Price setting instead of providing a motivating KPI for the procurement team.

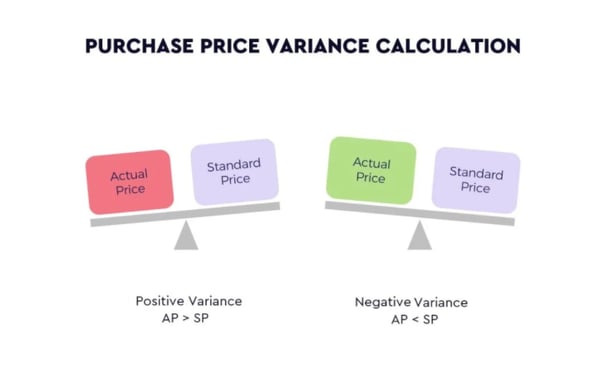

However, it's good to understand the general meaning of the formula:

A Positive Variance means the actual costs are higher than the budgeted.

A Negative Variance means that costs are lower.

Interested in diving into more procurement insights? Check out our guide Spend Analysis 101

PPV in finance budgeting

Direct material purchases can add up to 70% of all the costs in manufacturing companies.

Hence, budgeting and following up on material prices is a key job of any finance function in this type of business.

When a financial budget is created, the exact price of materials is unknown. So, the best estimate needs to be used. In accounting, this best estimate price is called Standard Price.

After the budgeted costs are realized, companies have an accurate measure of the Actual Price and Actual Quantity of units bought.

PPV in financial planning

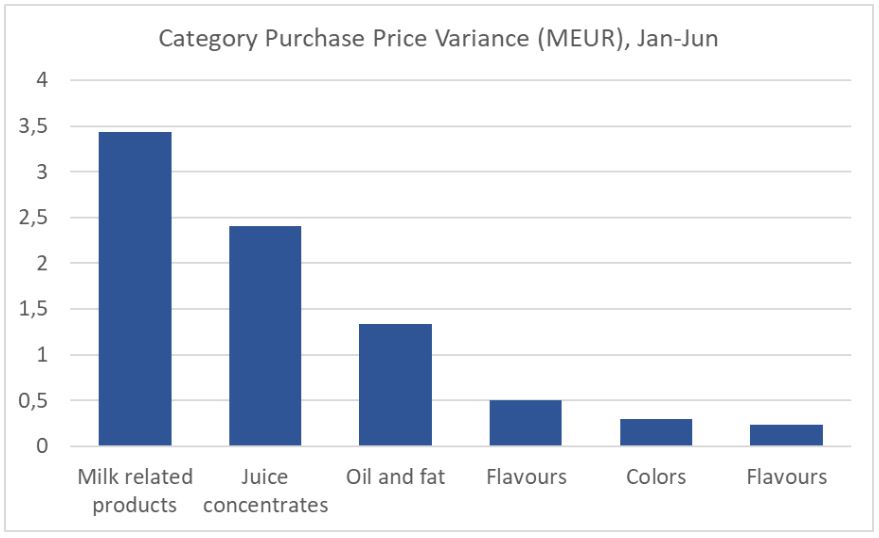

On the other hand, PPV is valuable for financial planning.

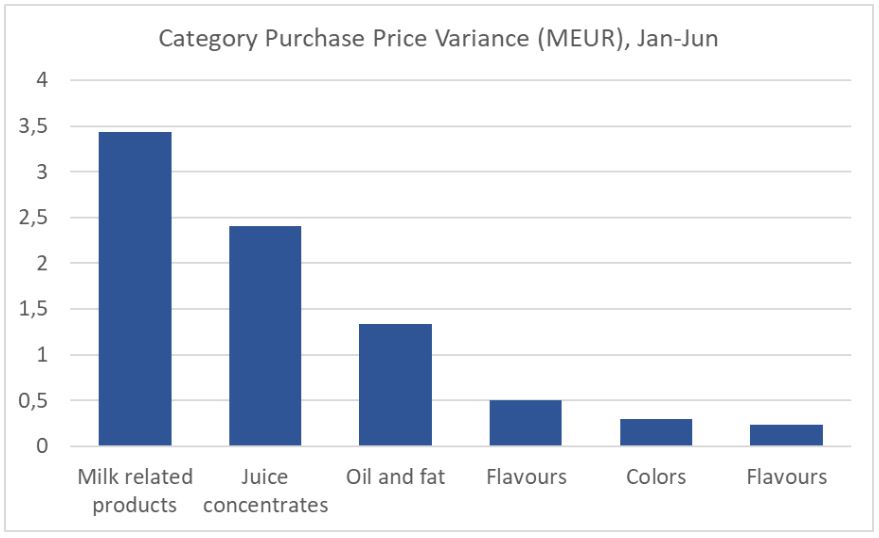

It explains how material price changes have affected your gross margin compared to your budget.

This is a key component in understanding the development of overall business profitability and thus a vital financial performance indicator.

And it is usually readily available from your finance systems where PPV calculations should happen automatically.

Forecasting Purchase Price Variance

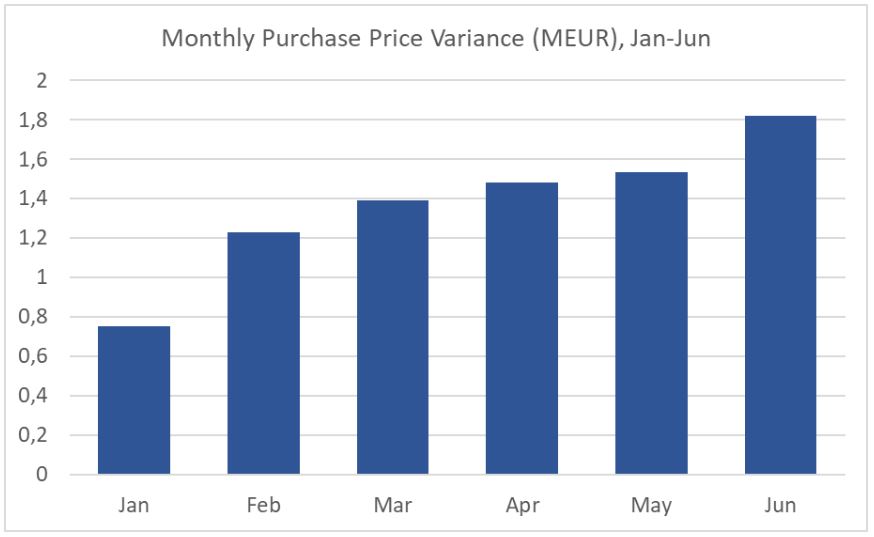

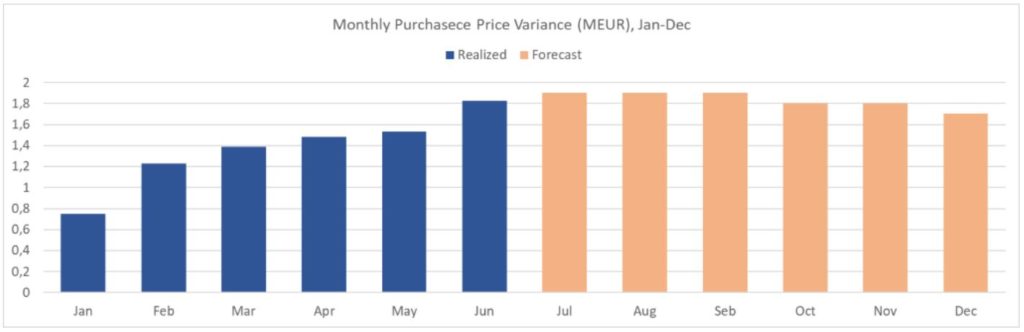

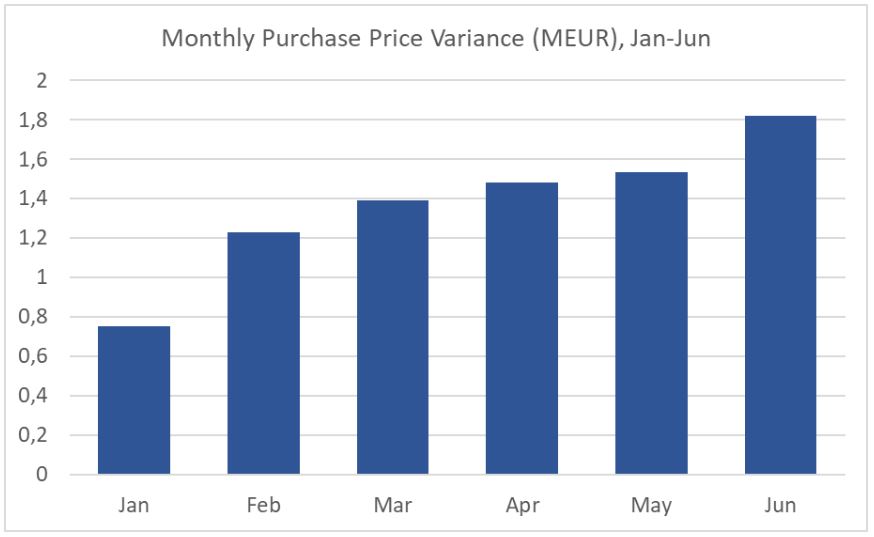

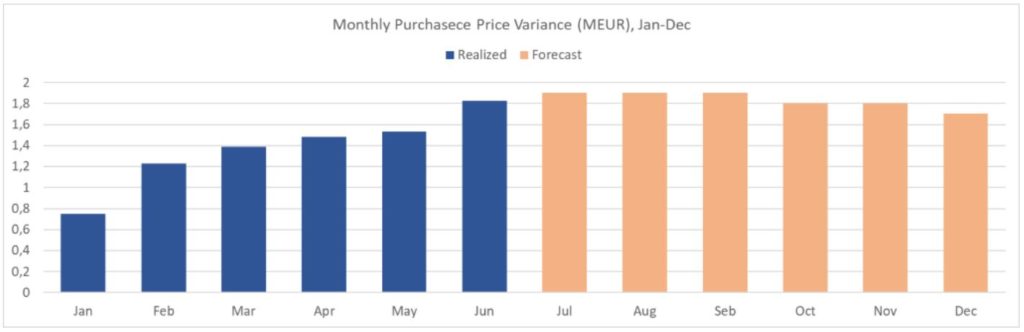

PPV is a historical indicator telling you what has happened in the past. Imagine, however, how powerful a forward-looking PPV indicator would be.

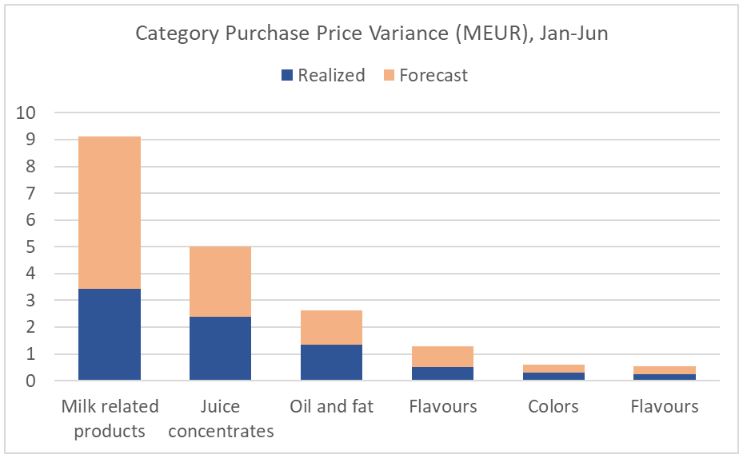

Enter Forecasted PPV, a performance indicator that can highlight the future risk to your gross margin and overall profitability.

The math needed to calculate Forecasted PPV is straightforward and similar to the Realized PPV formula:

Forecasted PPV = (Forecasted Price – Standard Price) x Forecasted Quantity

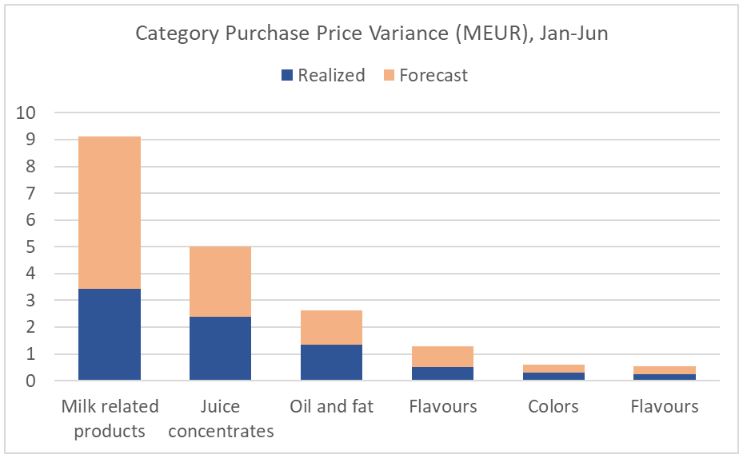

With Forecasted PPV business units gain the much-needed visibility on how material price changes are expected to erode gross margins.

You can proactively take needed actions to protect those margins. Finance teams can confidently adjust their forecasts with forward-looking statements that explain the effect of material price changes.

Challenges of forecasting PPV

So, if Forecasted PPV is such a great performance indicator and simple to calculate, why are not all companies using it?

The problem is that Forecasted PPV can’t be automatically calculated by your ERP or finance system.

Your SAP contains your Standard Prices, but coming up with reliable data on Forecasted Prices and Quantities is a much more complex exercise.

Forecasted quantities should be based on expected market demand (and production volumes), but often this information is not accurate or available for all business units and regions.

The data you need

Quantity forecasts are usually the result of combining

- Data from demand planning and MRP systems

- Extrapolated historical quantities and previous forecasts

- Manual entry and adjustment by persons who best understand demand

Forecasted prices can come from purchasing systems with long enough visibility to contracted prices. Still, procurement people need to manually estimate at least the key materials based on their view of the supply market and with the help of cost structure models.

In a large enterprise with multiple source systems for forecast data, tens of thousands of material numbers to be forecasted and a score of plants and business units involved in the process.

Building and maintaining a regular Purchase Price Variance Forecast is not a task to be taken lightly!

PPV Forecasting made easy

Sievo’s Materials Forecasting is a purpose-built solution for all purchase-related forecasting needs. And if you are looking for a system for Purchase Price Variance Forecasting, we got you covered.

But don’t take our word for it. Hear what Chris from Becton Dickinson has to say about Sievo Materials Forecasting:

Intrigued? Request a personalized demonstration from our website.