In procurement, a commodity is a raw or semi-processed material used to produce a good. Commodities include chemicals, agricultural produce, oils, minerals, and fuels.

The range of commodities is growing to include alternative energy sources, synthetic materials, and specialty metals. Intangibles such as labor and support services are not considered to be commodities.

Ensuring a reliable supply of commodities at the right price, paired with accurate demand forecasting, is a complex art to master.

Commodities are business-critical items of high value and are subject to significant fluctuations in price. There is a shift from a just-in-time (JIT) supply strategy toward companies maintaining reasonable buffer stock that considers the risk of supply disruptions.

The pandemic was a stark reminder that procurement and suppliers are mutually dependent. The commodity marketplace is unpredictable, and buyers must adapt to this volatile environment with their supplier network.

What is commodity price risk?

Price risk means the risk of unmanageable price increases. Out-of-control price fluctuations impact the financial performance and profitability of the business.

Fluctuations in commodity prices affect production costs, product pricing, profitability, earnings, and credit availability.

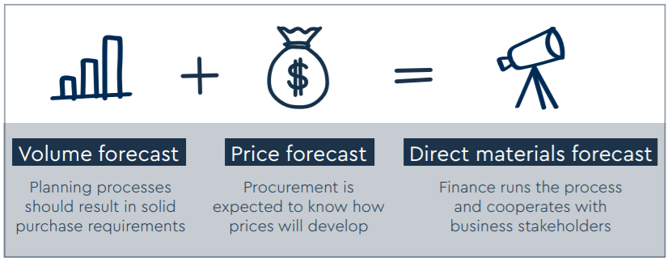

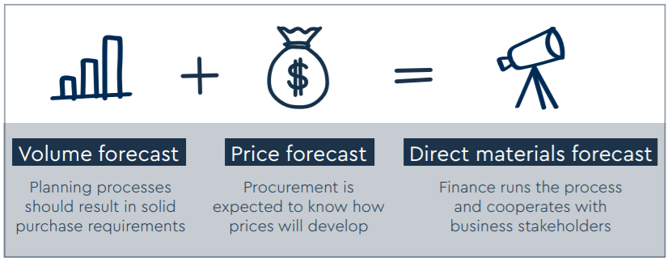

Commodity price fluctuations affect the profitability of the company and its ability to forecast and plan for the future. The responsibility for managing commodity price fluctuations often sits within Procurement, although the Finance and Treasury functions play a vital role in devising strategies to mitigate the overall business risk.

Procurement often is in the closest connection with the external partner network and therefore has access to data and insights that might indicate market price changes.

Price volatility

Commodity price volatility needs to be addressed to maintain profitability. Price fluctuation is not likely to lessen or disappear.

McKinsey reports that due to geopolitical and climatological unpredictability, "the annualized volatility of commodity prices averaged 10 to 20 percent over the past four years, with annual price swings of up to 70 percent of that year’s average price.”

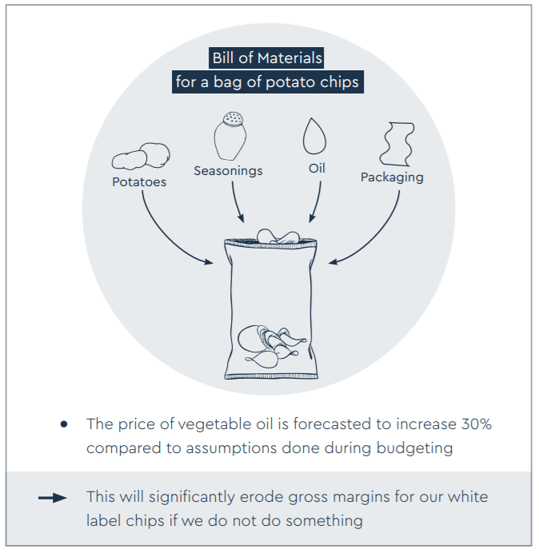

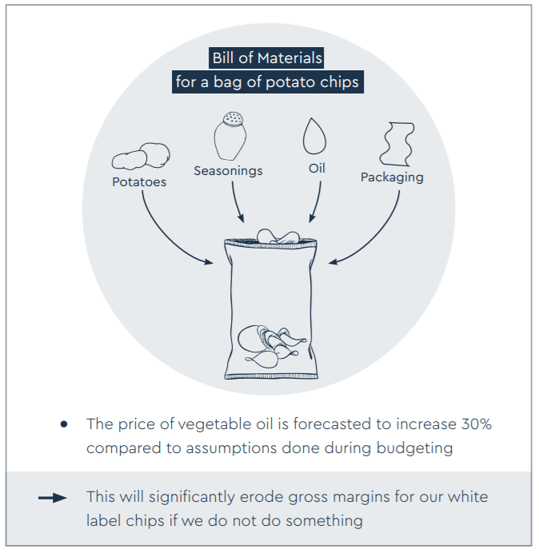

Price fluctuations in the purchase prices of commodities lead to uncertainty in the profit margin of the finished product.

Failure to manage price increases may lead to the need to pass the extra cost on to the customer or restructure the bill of materials (BOM).

3 ways to mitigate price volatility

Mitigating price risk means reducing cost uncertainty. Most organizations procure their commodities based on market pricing.

This is achieved by using long-term supply contracts or spot buying. To mitigate risk, companies usually use either:

- Financial hedging. Financial hedging is an action that protects against adverse price movement to remove uncertainty.

- Supply strategies. Companies may use multiple suppliers to ensure competitive pricing and mitigate the impact of potential price increases or apply a collaborative partnership approach. They may implement fixed price purchase agreements or agreements with a pre-agreed cap for price increases.

- Demand management. Reconstructing product BOM and reducing the use of the commodity is an alternative means of managing adverse price effects.

1. Financial Hedging

Financial hedging aims to mitigate the risk of external market price fluctuations.

Derivative instruments such as forwards, futures, swaps, and options are some instruments companies use to mitigate risk.

There is a lack of understanding in some procurement teams as to how futures or forward contracts work and the range of hedging options that are available to them. Liquidity differs between instruments affecting their effectiveness in differing situations.

Hedging involves interacting with external parties such as brokers and their chosen exchanges such as Euronext, the Intercontinental Exchange, and the Shanghai Futures Exchange.

Using an outside trading company or broker can be more expensive than hedging the exposure, but the benefit can be greater flexibility and peace of mind.

Management of commodity price risks and using instruments to hedge these risks require a robust governance structure.

Many companies are tempted to hedge their commodity prices when market prices are low, which is equivalent to betting on the market. If a risk is difficult or expensive to hedge, the focus must be on reducing the exposure to that risk.

2. Supply strategies

Fixed price agreements with one supply partner mean that volumes are secured for the duration of the contract, usually at the prevailing market price.

This enables both parties better plan their financials for the years to follow. Variations on this type of contract can include price caps, either a fixed % increase or increases aligned to a commodity price index.

This way, the risk of price increases is shared between the supplier and the buyer, leaving both parties responsible for managing their financial performance efficiently to avoid and plan for the harmful impact of commodity price increases.

Long-term “collar price” limits define the maximum and minimum prices, which avoid large positive or negative fluctuations. There may be an opportunity to engage with second-tier suppliers within these contracts for fuller transparency and security.

Contracted suppliers with well-developed supply market intelligence skills have an advantage when negotiating raw materials and commodity pricing.

Procurement should be equally well informed and make educated supply decisions. Engaging with multiple suppliers is an alternative strategy, but there is a downside, you lose price leverage on volume commitment.

Mid-size companies have focused more on risk management and opportunistic hedging than fixed-price contracts. The gradual shift from a cost-managed approach to a combination approach is a trend. Hedging instruments like futures, swaps, and options play a part in offsetting risk.

3. Demand management

Another way of managing commodity prices is to reduce the reliance on that material through changes to design, production, or supply chain processes.

This can be achieved through re-specification, continuous supplier improvement, and promotion of innovation practices. Procurement can identify cost-effective alternatives together with various stakeholders or try to challenge demand.

There may be an opportunity to change the product mix, thereby reducing the need for commodities that are particularly subject to fluctuating prices.

To provide a practical example, in the food industry, prices of grains and oils are volatile, and cheaper substitutes may be possible.

What is procurement’s role in managing commodity prices?

To manage commodity risk, a successful category manager needs to:

- understand the most important commodities per supplier and the finished product cost drivers,

- be immersed in their commodity markets and proficient in benchmarking techniques,

- have access to real-time market price data, forecasts, and trends in a centralized database, and

- become proficient in supply contract negotiation and financial risk management.

The nature of commodities, internal purchasing requirements, and risk appetite all together dictate the nature of sourcing management.

Commodity buyers should perform thorough due diligence to understand the external market dynamics and internal requirements to determine the risk mitigation approach.

Understand how analytics can be used in Material Forecasting!

Sievo has partnered with key market data providers to enrich your data with current market developments. Sievo provides you the transparency to see which areas of your spend are exposed to market price volatility, enabling you to assess financial risk and seek opportunities within categories.

Header picture credit: Erwan Hersy (unsplash.com)