The main goal of procurement is to ensure products and services are bought at the right price. Cost savings still is the #1 key performance indicator for CPOs.

This can be measured via hard savings or so-called cost avoidance. The debate on how to measure the value of procurement savings is ongoing...but we have some opinions.

For procurement to have credibility and prove its value to business stakeholders, it first needs to build trust with Finance. To succeed in this, both must agree on savings definitions and the methods used to calculate and validate savings.

In this blog, we'll explain how to align savings, real-world examples of procurement savings, and tips on how to measure savings.

If you want this and more, don't forget to download our complete guide: Ultimate Guide to Procurement Cost Savings.

Aligning on savings: how each function sees it

We all know that savings can mean a lot of things. However, most fail to see from the other's perspective. Let's start by identifying how Procurement and Finance may generally start off on the wrong foot.

How Procurement looks at savings

Procurement generally considers cost savings as the decrease between the previous cost paid and the new negotiated cost.

In the absence of a previous cost reference, savings could be calculated from the first offer received or market benchmarks.

Procurement would ideally like to record savings at the point of negotiation or on confirmation of a signed contract when they can sit back, relax and hand over the contract to business for execution.

But that doesn’t translate to actual cash savings - it only tells us what is the savings potential. The actual realized savings are harnessed later.

Realized savings are dependent on any change in the level of business activity and stakeholder compliance to the contract. In addition, factors outside of our control have an impact on cost level: changes in raw commodity prices, currency fluctuations, and labor cost index level.

How Finance looks at savings

Finance views savings from a different angle. For Finance, savings are something that has an immediate impact on the company budget and balance sheet.

These are often called “hard savings”. Finance professionals expect reported savings to translate immediately into a decrease in costs.

Unfortunately, this is not the case as it may take time for the savings to realize and there may be external hiccups along the way.

Finance’s approach to measuring savings is to match expenditure against budget, i.e. what did we spend compared to what we planned to spend in a given period. Budgeting, therefore, plays its part in the Finance savings equation.

How to align the view

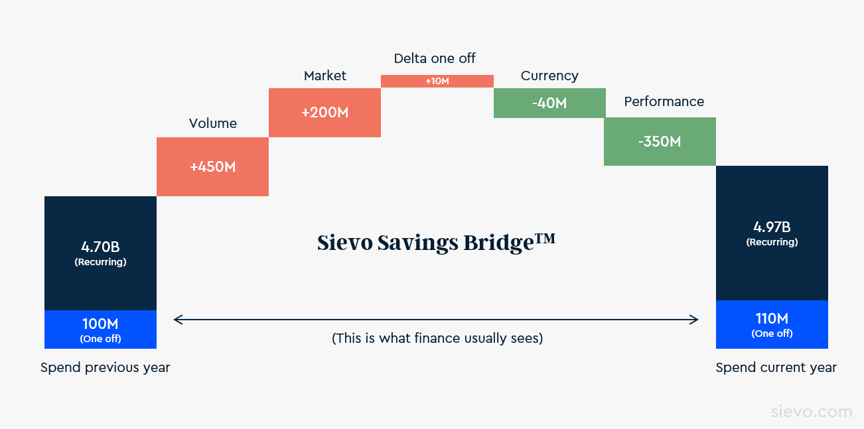

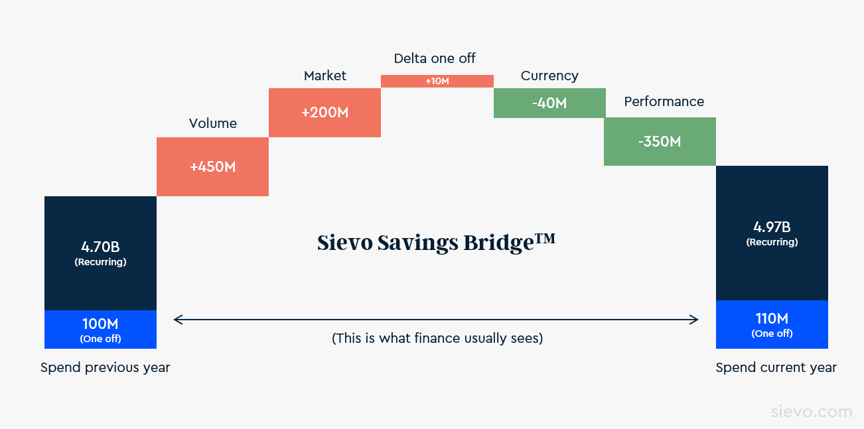

There is often a mismatch between Procurement’s claimed savings and what Finance sees when it studies the profit and loss (P&L) account.

Key reasons for misalignment and conflict between Procurement and Finance include:

- lack of common language and terminology when talking about savings.

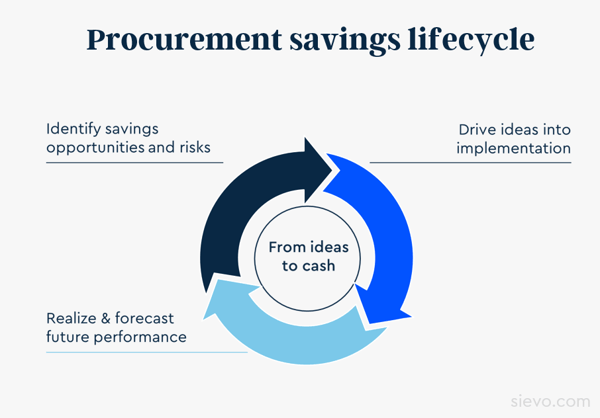

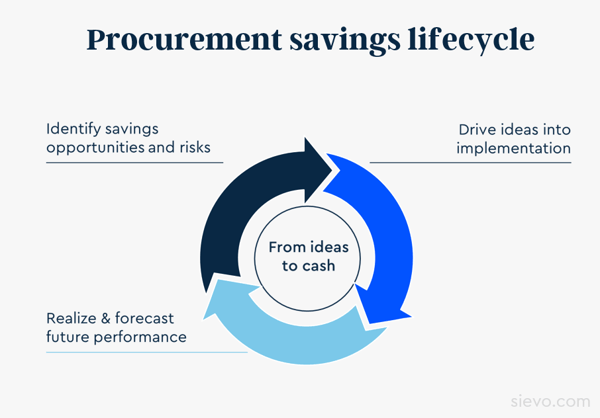

- measuring only contracted savings rather than all the steps of the savings lifecycle model.

- focusing only on proactive savings projects and neglecting the external factors.

If there is a major gap between actual and budgeted spending, one could ask how collaboratively the budget was constructed, how careful the initial assumptions were, and how actively the budget was updated to consider possible market changes during the budgeting period.

These mismatches could be partly avoided with active dialogue, expectations management, and higher levels of transparency between Procurement and Finance.

The level of collaboration between finance and procurement varies in organizations. When the Procurement function reports directly to the Chief Financial Officer (CFO), agreeing on the budgeting and savings calculation principles is relatively straightforward.

To get clear on savings, we use a model called the SavingsBridge to connect procurement and finance thinking. You can read all about it in our free eBook Procurement ❤️ Finance.

Examples of procurement savings

Savings in procurement can mean many things and come from different places. In this chapter, we will give some examples in practice.

Savings types

Procurement savings can be divided into 5 savings types:

- Hard Savings

- TCO Savings

- Working Capital Optimization Savings

- Spend Under Management Savings

- Soft Savings

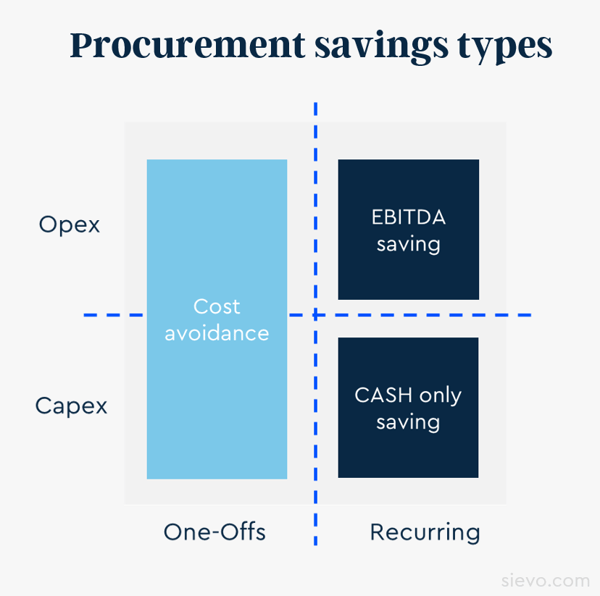

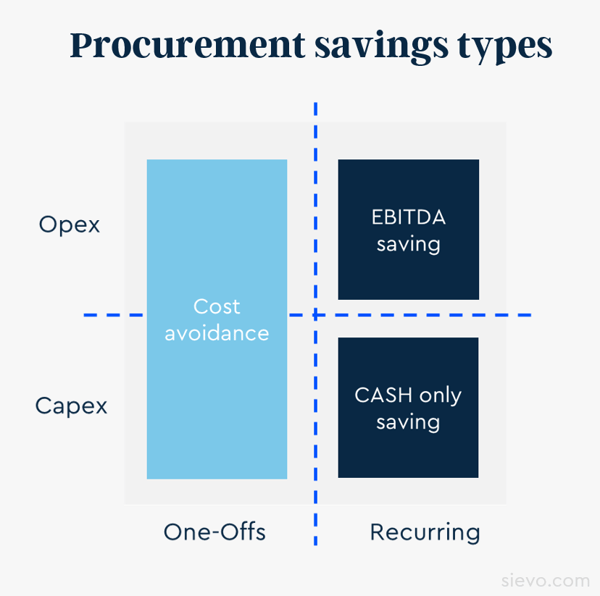

Another way to look at them is based on their occurrence (recurring or one-off) and impact on cost structure (opex or capex impact):

Cost avoidance is often termed ”soft savings”. Treatment of cost avoidance is the most argued issue when talking about procurement savings.

Read: 11 Cost Reduction Strategies for Procurement

According to CIPS, cost avoidance is "a reduction in cost resulting in a spend that is lower than would otherwise have been if the cost avoidance exercise had not been undertaken.”

Soft savings are hard to measure but an incredibly valuable savings method. Soft savings are simply best practices for procurement and should be part of every person’s toolkit.

Savings examples

Savings opportunities present themselves in various ways. Let’s look at the following examples (however, note that not all have a simple savings calculation).

Let's start with some easy ones:

Sourcing a new commodity (hard savings)

You receive competitive price offers for a new type of carton. There is no baseline to measure savings against.

You negotiate a 10% discount on the best price offered across all bidders. The actual savings can be calculated as:

👉 Average bid price less price achieved X number bought = savings

Project sourcing (soft savings)

Through strategic sourcing initiatives, you manage to limit the impact of cost increases in plastic cartons through monitoring the global market for raw materials.

This year has seen a price rise of 20% in the price of plastic.

Through long negotiation, the cost increase was limited to 15%.

👉 Cost avoidance could be written off as a 5% savings.

Design change (Re-specification/ Total cost of ownership savings)

The design team changes the specifications on a type of carton. The closure on the carton is simplified, and there is a saving of 10% on the price of a closure.

👉 This is a cost-saving, but is it a procurement saving?

Total cost of ownership (outsourcing/ Total cost of ownership savings)

You identify with business that a certain part of its operations should be outsourced to a specified vendor.

The handover is successful, and eventually, the total cost of that service decreases compared to in-house operation.

👉 Is this procurement saving?

Payment terms (Working capital optimization savings)

You have changed to a supplier with a lower unit cost for paper cartons but with a higher minimum order quantity (MOQ) and longer payment term.

The unit cost per carton is considerably lower, but a new higher MOQ leads to higher inventory value and warehousing costs.

Procurement has negotiated a longer payment term with the same supplier. This has a positive impact on the working capital at hand.

👉 Is this calculated as cost-saving or cost increase, or both?

Rebate

You are currently paying a license fee per annum for a software tool. After year one the vendor sends you a renewal contract.

The renewal for year 2 includes a 10% increase over last year. You avoid the 10% increase by promising to renew for year 3 or by foregoing some of its features.

👉This is cost avoidance but is it a real saving?

Consumption change (hard savings?)

You have negotiated a lower price for paper cartons. However, in the next period sales are up, and you buy more cartons.

Despite the lower unit price, the total expenditure increases.

👉 How is the unit cost saving recorded?

Calculating savings is further complicated by the impact of one-off costs, volume rebates, changes to payment terms, late deliveries, emergency orders, warehousing costs, and more.

How to succeed in savings calculation

There is no right or wrong method for calculating savings, but there are three success factors for doing so:

1. Formalizing and agreeing on savings methodologies

Successful savings calculation starts with agreeing on a common methodology. Regardless of the saving type, it’s important to always align the savings with finance so that savings can be identified in the financial statements.

These are the type of questions to ask:

- Do you set baselines by category or commodity or by cost center?

- What is the baseline for savings you will calculate savings against?

- Are you considering verified market cost changes?

- Are you considering cost avoidance as saving or only focusing on “hard savings”?

- Over what period will you measure and report savings? Monthly or quarterly or annually?

- For multi-disciplinary sourcing projects who gets to claim the savings?

Answers to these questions will provide the basis for the agreement on reported savings.

2. Tracking realized savings

At what point is it fair to claim a procurement saving?

The concept behind realized savings tracking is clear – after a contract has been executed, invoices are tracked for an agreed period to validate exactly how much money has been saved.

Many well-negotiated cost savings may be lost during a contract period due to ”leakage” of orders to non-contracted suppliers. This is called “maverick buying”.

Value leakage means the difference between identified savings potential and actual realized savings.

Value leakage can be caused for instance by suboptimal design, poor measurement of savings, weak adoption, insufficient change management, and/or inefficient execution of the contract.

Therefore actual purchases need to be monitored via paid invoices to ensure the accuracy of cost-saving claims.

Savings tracking can be complex if there is a large amount of data and there are multiple rules applied to different types of savings.

Software tools have been developed to automate these calculations and are often offered as a facility in cloud-based spend analysis solutions.

3. Reporting realized savings accurately

Savings should only be reported on addressable spend, i.e., the spend under the influence of procurement.

Reporting to Finance needs to be focused on the “hard savings," those that can be proven and that find their way into the accounts and eventually have an impact on the PL sheet and future budgeting.

When reporting savings to other stakeholders and showcasing their impact on business, it is possible to include those “soft savings” achieved through cost avoidance initiatives.

Even if it might not be recognized by Finance, procurement should be tracking both “hard savings” and “soft savings” to capture and communicate the total value delivered to the business.

From a procurement perspective, it is important to track planned vs actual savings. What matters for the bottom line of your business is that identified savings opportunities through spend analysis are turned into an actual reduction of expenses.

This information helps with future resource planning as well as performance management. Understanding savings achieved by the cost center or division highlights where the contribution comes from.

Cover picture by: BP Miller