For manufacturers, the difference between steady margins and sudden shortfalls often lies in the quality of direct materials forecasting. When done well, it links procurement assumptions with financial planning and gives executives time to act. When done poorly, it reduces forecasting to a backward-looking exercise.

What Is Direct Materials Forecasting

Materials forecasting involves building direct materials cost budgets and forecasts that show how price and volume changes will affect future profitability.

In theory, the process is simple:

-

Pull volume forecasts from ERP and planning systems.

-

Add Procurement's price outlooks.

-

Consolidate, visualize, and review with stakeholders using fit‑for‑purpose analytics or manufacturing cost forecasting tools.

The challenge is not intent but execution. Many companies still run forecasts only a few times per year. By the time data is consolidated, assumptions have shifted.

Revenue-side planning, by contrast, usually follows a mature cadence with integrated tools and dedicated teams. Cost-side forecasting is less robust.

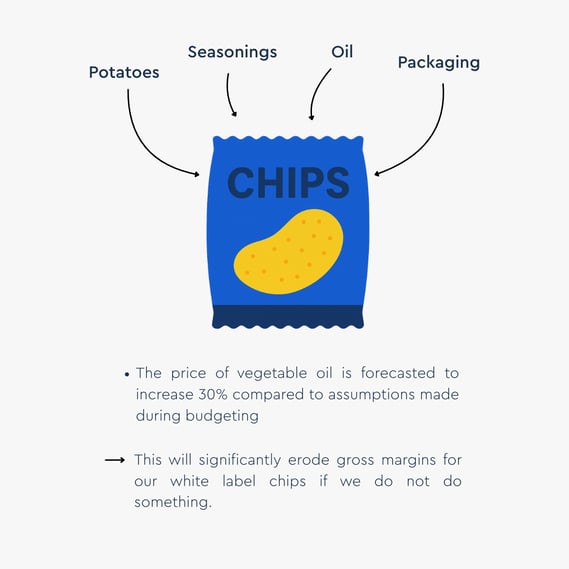

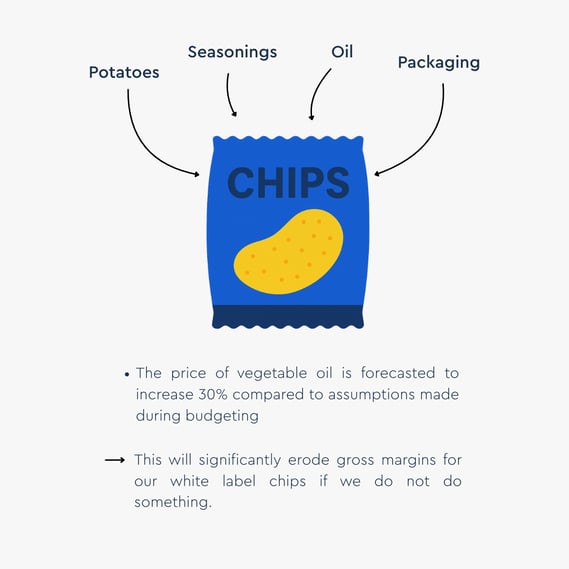

Example: Snacks And Vegetable Oil

In the fast-moving consumer goods (FMCG) sector, manufacturers of packaged snacks rely heavily on vegetable oil. Price volatility in that single input can shift overall earnings. This is the kind of cost dynamic executives need to see in advance, not after quarterly results are closed.

Four Steps to Improve Direct Materials Forecasting

-

Unite Procurement and Finance

Both functions should work from a single dataset with shared accountability. Real-time validation must replace after-the-fact reconciliation. A common source of truth speeds decisions and makes ownership explicit.

-

Automate What Matters

Spreadsheets and manual consolidation consume time without improving accuracy. Automating forecast generation and validation shortens cycle times and allows teams to focus on negotiations, sourcing calendars, and risk, ideally supported by modern manufacturing cost forecasting tools.

-

Build Data Intelligence

Where possible, external indices add context, but even without them, greater detail at the category level raises accuracy and makes the data more useful for decision-makers. This turns a basic material forecast into a decision-ready signal.

-

Using What-If Simulations

A static forecast, no matter how accurate, provides only a single view of the future. What-if simulations enable procurement teams to explore multiple potential scenarios and their financial impacts.

These simulations stress-test procurement strategies against various market conditions and disruptions. Possible scenarios to explore are commodity price spikes, supply chain disruptions, currency fluctuations and demand variations.

Move Toward Continuous Forecasting

Organizations that move beyond episodic cycles see faster, more informed decision-making. Key practices include:

-

Tighten governance so the forecast is decision-ready, not just report-ready

-

Assign Finance ownership of the end-to-end output

-

Assign Procurement ownership of market intelligence, supplier inputs, and category assumptions

-

Replace semiannual cycles with rolling updates tied to market signals and volume changes

-

Link forecasts directly to sourcing calendars, negotiations, hedging, and supplier capacity plans

With shared data, aligned metrics, and clear accountability, Finance and Procurement move faster and with less finger-pointing.

Frequently Asked Questions (FAQ)

What is direct materials budgeting and forecasting in practical terms?

It means creating direct materials cost budgets and forecasts that show how raw material price changes will affect future gross margins and profitability, using ERP volumes and Procurement's price outlooks.

Who should own the material forecast?

Finance should own the end‑to‑end process and consolidation; Procurement should own market intelligence, supplier inputs, and category‑level assumptions used in the forecast.

Why is it crucial to have an agile materials budgeting and forecasting process?

Materials budgeting and forecasts often lag reality; companies miss signals until margins are already hit. An agile process reduces that delay by tightening governance, linking forecasts to sourcing and supplier actions, and using tools that integrate relevant volume and price data, such as market indices

How can we improve materials forecasting speed and accuracy without increasing headcount?

The key is to bring together all relevant data sources in a way that aligns with business needs. Start by simplifying where possible - using last purchase prices can be a perfectly sufficient baseline for certain categories. Then, apply more detailed logic only where it adds real value, such as categories that benefit from market index–based forecasting. Mature systems take this further by automating scenario generation, pulling volume and price data from ERPs, and sometimes combining it with market index data for key categories in a single tool. This reduces manual effort while improving both speed and accuracy.